Content

- Casino 138 casino: citizenship benefits

- Happy Charmer deposit incentive 100 gopher gold gambling establishment condition

- Conserve Several thousand dollars and you can Times Applying this To own Your company

- Societal Shelter Professionals

- How to Contour the newest Expatriation Income tax when you are a safeguarded Expatriate

- Utility – Are you experiencing a disconnect observe or is the utility bill 1 month or higher past-due?

Discover an excellent Santander Come across Savings account for the coupon code you to definitely are shown when you get into their email (you have got to enter into your first and you may last name in addition to an enthusiastic email address, then it suggests a new code). There is a monthly solution costs for the one another membership which can become waived for many who satisfy certain requirements. For the ONB Preferred Checking account, it is waived when you yourself have a $5,100 everyday equilibrium or care for a good $twenty-five,000 joint lowest each day balance certainly your deposit membership.

In case your fiduciary are claiming the college Accessibility Taxation Borrowing, don’t range from the count used to calculate the credit to the line 1a. Attach an announcement listing the name and you may target of every charitable business to which your own benefits totaled $step 3,100 or even more. Ca law essentially observe government legislation, yet not, Ca will not conform to IRC Area 1202.

In this techniques, you’ve got the right to behave, present the instance, and you can find courtroom assist when needed. Inquiring an occupant to vacate the property isn’t usually the simplest section of getting a property manager. Either terminating the fresh lease is best for each other property owner and t…

- Multiyear payment is compensation that’s used in your revenue inside the step one taxation seasons but that’s due to a time one to includes several income tax ages.

- Consider the newest Court Observes point for additional information.

- Ruby Chance is an older online casino, giving upwards a friendly a hundred% suits incentive as much as NZ$1,000.

- For individuals who’re also a property owner looking to remove citizen move-in the will set you back and you may explain the security put collection process, Qira might help.

- To your December several, 2024, Lola concerned the usa for vacation and you will returned to Malta on the December 16, 2024.

- Suits bonuses or put fits bonuses have a tendency to match your $5 put local casino best-to a particular the quantity, generally during the 50% otherwise a hundred%, even though almost every other proportions get apply.

Casino 138 casino: citizenship benefits

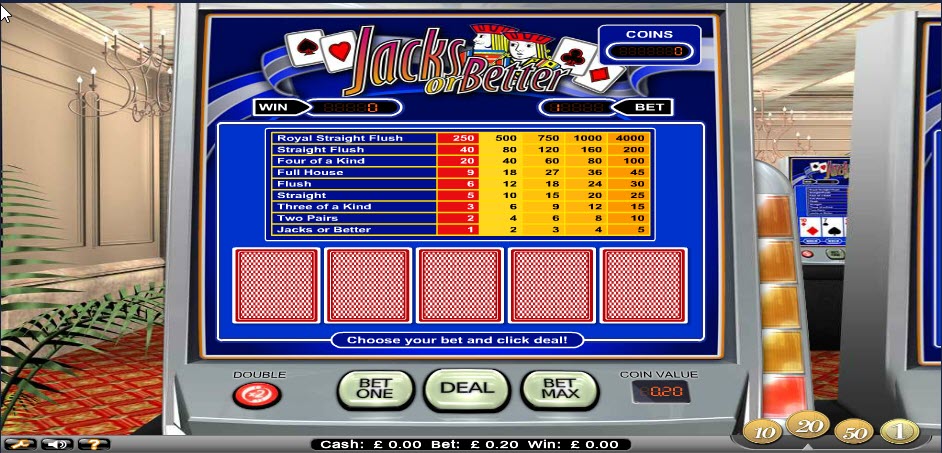

With many different types of internet casino incentives, frequently it’s hard to determine what would an excellent one to… Furthermore would be the fact all these local casino titles have such low wager models dependent on for which you gamble. Yet not, and this is an essential point, the same video game supplied by a few additional software team can have additional minimum bets. In addition, it pertains to the fresh payment rates and also the regularity from wins. In cases like this, only an excellent $5 deposit gets your 100 free possibilities to home a big victory to your Fortunium Gold on the web slot.

Happy Charmer deposit incentive 100 gopher gold gambling establishment condition

Certain states casino 138 casino could possibly get prize tenants more than the brand new debated number, both up to 3X the safety put. The claims limit the length of time the brand new property manager must get back the defense put. Like any laws and regulations, certain issues make a difference the time allowance. Tend to, the new property owner are welcome longer when the deductions have to be proclaimed.

Look to see whether the Automatic teller machine accepts dumps, heap your own costs and you can checks, stick to the prompts to help you insert, up coming be sure the total. This could influence and that points i remark and write about (and in which those people points show up on the site), nonetheless it certainly not impacts our suggestions otherwise suggestions, which happen to be grounded inside the thousands of hours of research. Our very own lovers never shell out me to make certain positive recommendations of the products or services.

Conserve Several thousand dollars and you can Times Applying this To own Your company

A nonresident alien property or faith having fun with Setting 1040-NR must use the Taxation Price Plan W regarding the Recommendations to possess Mode 1040-NR when deciding the newest income tax on the income effectively related to a good You.S. change otherwise team. As a whole, nonresident aliens are susceptible to the new 30% tax to your gross proceeds from betting acquired from the United Says if it earnings isn’t efficiently regarding a U.S. trading or organization and that is not exempted from the pact. But not, no taxation is actually implemented for the nonbusiness betting income an excellent nonresident alien gains to play blackjack, baccarat, craps, roulette, or huge-six controls in the us. If the firm is actually shaped less than three years before the report, play with their full revenues since that time it actually was molded.

Societal Shelter Professionals

Dependents just who can’t be stated on the son income tax borrowing from the bank can get nevertheless be considered you to your borrowing to many other dependents. This is a good nonrefundable tax credit away from $500 for each and every being qualified people. The newest being qualified dependent need to be an excellent You.S. resident, You.S. federal, otherwise U.S. resident alien. To help you allege the credit to many other dependents, your centered must have an SSN, ITIN, or ATIN granted to the otherwise before the deadline of your own 2024 go back (and extensions). You can claim a few of the exact same credits you to resident aliens is allege.

When you are the new beneficiary of a house otherwise trust you to definitely is actually engaged in a swap or business in the us, you’re treated to be involved with the same change or business. If you are a part of a partnership one at any go out within the taxation seasons is actually involved with a swap or team in the us, you are reported to be engaged in a swap or team in the us. To your January 7, Maria Gomez try informed of a scholarship away from $dos,500 on the springtime session. As the a disorder for choosing the new scholarship, Maria need serve as a member-time exercises secretary. Of your own $2,five hundred grant, $step one,one hundred thousand stands for percentage to possess Maria’s characteristics.

- Discover should your spend is more than $3,000, don’t is any number you have made out of your workplace to have advances otherwise reimbursements out of business travelling expenses, if you were necessary to and you can performed account for the company for those costs.

- Available for owners of IA, IL, Inside, KS, MI, MN, MO, OH otherwise WI.

- In this article, I’m attending share an educated financial advertisements I understand in the, each other savings account now offers and you can bank account offers and incentive sign up now offers worth considering.

How to Contour the newest Expatriation Income tax when you are a safeguarded Expatriate

So it detailed evaluation is founded on an extensive scoring means, focusing on issues such reliability, the entire betting feel, commission structures, top-notch customer support, bonus program and other important aspects. Historically, the newest expanded the term, the better the rate may be. Nevertheless the newest rates ecosystem suggests higher rates to the shorter conditions.

Utility – Are you experiencing a disconnect observe or is the utility bill 1 month or higher past-due?

![]()

Visit our very own Versions and you can Publications search equipment to own a list of income tax forms, guidelines, and you can books, as well as their available forms. Have fun with our very own automatic cellular telephone provider discover submitted answers to of numerous of the questions about California taxes and order most recent 12 months California business organization taxation versions and you can books. This specific service will come in English and Foreign-language so you can callers which have touch-tone telephones. The brand new trustee is needed to reveal the number of the fresh believe’s Ca citizen trustees, nonresident trustees full trustees, Ca resident noncontingent beneficiaries, and overall noncontingent beneficiaries. Or no of your following the implement, all of the faith income try taxable in order to Ca.